Cost of Sending iPhone XR, XS Max to India Calculator 2018

How much does it cost to send a new iPhone Max to India from USA? Any idea? We list all costs including shipping, insurance custom duty in India with GST tax for sending any phone including Google Pixel 3, Samsung Note, Samsung Galaxy to India with an example of iPhone. Open Indian Custom Duty Calculator in new windowWith the season of new mobile phone launches in USA ahead, the eagerness to import it from USA and get it in your hands before it is launched in India is pretty high.

But, wait, you may be paying much more for that device if you decide to buy from USA and ship it to yourself in India, the legal way.

Cost of sending iphone to India from USA

Here are the sample costs involved for iPhone & iPhone models:

| iPhone XR | iPhone XS | iPhone XS Max | |

| Basic Price (in USD) | 749 | 999 | 1099 |

| Sales Tax (@6.5% - Could be different in your state) | 49 | 65 | 71 |

| Shipping to your home or pick - up from store* | 0 | 0 | 0 |

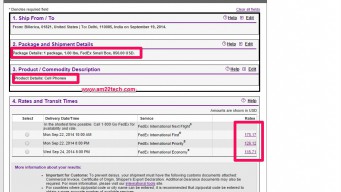

| Mailing Cost (Fedex/UPS - standard shipping - 1 pound packet) | 126 | 126 | 126 |

| Transit Insurance (@2% of declared value) | 16 | 21 | 23 |

| Total (in USD) | 940 | 1211 | 1319 |

| Total (in INR)(1 USD = INR 70) | 65,800 | 84,770 | 92,330 |

* I assumed that Apple offered free shipping or you picked up the phone from an apple store to keep this cost as zero.

Cost of sending iphone to India by Fedex

Mobile phone Custom Duty, GST Tax in India

You will have to pay customs duties and GST tax before the phone is delivered to you in India. The mobile comes under the cell phones category.CIF cost means the total of Cost, Insurance and Freight.

For the purpose of customs validation, the CIF value is the price paid for the goods plus the cost of transportation, loading, unloading, handling, Insurance and associated costs incidental to the deliver of good from place of export to place of import.

All other charges are calculated on this CIF value.

In our example, this CIF value is the total money that you have spent for the item in USA including all expenses.

| All in INR | iPhone XR | iPhone XS | iPhone XS Max | |

| A | CIF value (Total cost to send from USA) | 65,800 | 84,420 | 92,330 |

| B | Landing Charges (1% of CIF) | 658 | 844 | 923 |

| C | Sub-total (A + B) | 66,458 | 85,264 | 93,253 |

| D | Custom Duty (BCD - 20%) | 13,292 | 17,053 | 18,651 |

| E | Sub-total (C + D) | 79,750 | 1,02,317 | 111,904 |

| F | GST Tax (12%) | 9,570 | 12,278 | 13,428 |

| G | All other cess and charges | 0 | 0 | 0 |

| H | Total (E + F + G) Final cost to you | 89,320 | 114,595 | 125,332 |

| G | Total Customs (H - A) | 23,520 | 30,175 | 33,002 |

Hence, if you want to take a figure in your mind, you can consider about 34% of the CIF value as customs charges.For example: If the total cost (CIF) in INR is 60,000 for a mobile, then add about 34% of 60,000 as custom taxes and charges.

Final price would be: 60,000 + 20,400 (34% of 60,000) = 84,400.

Does it make sense to buy iPhone from USA and ship to India?

With high custom duties and taxes on importing, I would suggest to buy directly from India rather than get into the hassle of paying custom duties.If you carefully understand the calculations, you are approximately paying about 50% extra for the phone, if you import.Indian government takes hell of taxes here.

Mark mobile phone package as GIFT to avoid custom duty tax?

Read this detailed answer about gifts and their values for Indian custom duty:Who can be a sender of GIFT when sending Mobile?

Any person abroad can send gifts. There is no specific restriction that only relatives can send the goods.Business associate, friends, relatives, companies or acquaintances can also send the gifts to residents in India. No proof is required.

Who pays the custom duty and taxes on imported iPhone and how?

The receiver pays the custom duty and taxes. Normally, when the shipment reaches India, your postal company would run it through customs. Custom officer would create a custom invoice and the postal company would either call you to keep the money ready or ask you to deposit the money first.Once you deposit the money, you will be handed over your shipment.

Most of the companies these days like BlueDart, Fedex etc. have streamlined the process.

They would call you before coming to deliver the package and ask to keep the money ready. You pay the custom duty to the delivery boy itself.

What is the time frame to get iPhone shipped in India from USA?

As per the best estimates, the iPhone versions are shipped to USA resident in 5-6 days. Add another 5-6 days for shipping to India.Is there any GST tax on imported goods/mobile in India?

Yes, there is GST tax under called Integrated Goods and Services tax that's levied on imported mobile phones.Is there any sales tax on imported goods/mobile in India?

No, no sales tax is charged on imported goods at this time.I have made all calculations and provided information to the best of knowledge and research. Please correct or share more information about it if you had any experience of sending a mobile phone to India from USA.

Article originally published at am22tech.com. Reproduced here for wider distribution with copyright permissions.